Annual income

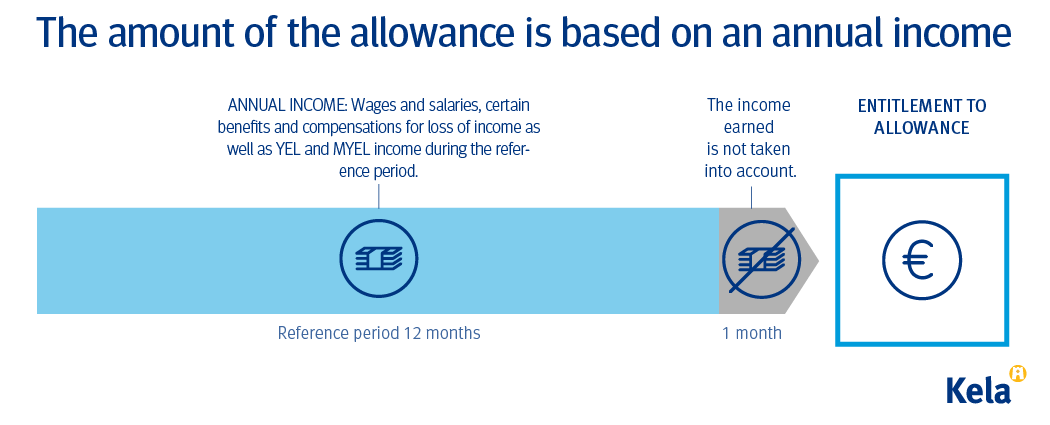

The amount of your allowance is based on your annual income. Your annual income is calculated for the 12 calendar months prior to the calendar month that precedes the start of your entitlement to the benefit. In certain situations, the allowance can be calculated on the basis of the last 3 months of the period. These situations include situations where you have been on child care leave or have graduated from your studies. You must separately request that your allowance is calculated based on your income for 3 months.

There is a 1 month gap between the reference period and the start of the allowance period, and the income during this one month is not included in the annual income.

Kela cannot issue a decision on the allowance until the reference period for the annual income has ended.

Example of applying for pregnancy allowance

Maija applies for pregnancy allowance for the period 27 October 2024 to 14 December 2024. The reference period for the annual income is 1 September 2023 to 31 August 2024. The decision can be issued at the beginning of September, at the earliest.

The following are taken into account as annual income for the reference period:

- wages and salaries

- salary for insurance purposes

- income under the self-employed persons' (YEL) and farmers' (MYEL) pension insurance schemes

- certain benefits

- certain compensations for loss of income.

The annual income can thus consist of one or several of the aforementioned types of income. As a rule, Kela receives the necessary information for determination of the annual income from the national Incomes Register, the pension and insurance providers and the unemployment funds, so this information need not be reported to Kela separately. If necessary, Kela may request further information from you or from the payer of the income.

Insurance contributions are deducted from the wages and salaries or salary for insurance purposes included in the annual earned income. In 2024 this deduction is 8.95 per cent. There is no corresponding deduction from earnings under the YEL and MYEL schemes.

Different types of income

Earnings from private- or public-sector employment paid during the reference period are included in the annual income. As a rule, Kela receives information on wages and salaries that are included in the annual income from the national Incomes Register, so this information need not be reported to Kela separately.

The employer must report wage and salary information to the Incomes Register within five days of the date of payment. You can check the information submitted by your employer in the Incomes Register (vero.fi/income register). You log in to the online service with your online bank credentials or a mobile ID. Please note that employers also report income that is not included in the annual income, e.g. reimbursements of costs, to the Incomes Register.

If you think that your earnings data in the Incomes Register contains inaccuracies or incorrect information, you should ask your employer to correct the information. You cannot correct the data contained in the national incomes register yourself.

Example of annual income calculated on the basis of wage or salary

Maija’s entitlement to pregnancy allowance starts on 14 August 2024. The reference period is 1 July 2023 to 30 June 2024. During this period, Maija received a salary of 2,500 euros per month (before taxes) and 1,125 euros in holiday bonus (before taxes).

Calculation of her annual income: 12 months x 2,500 euros + 1,125 euros = 31,125 euros.*

The amount of the pregnancy allowance and parental allowance for the first 16 days is about 85 euros per working day.

*) An insurance premium reduction (8.95% in 2024) is made on the salary income.

If you have worked abroad during the reference period, and a salary for insurance purposes has been determined for the duration of your employment abroad, your annual income is calculated on the basis of the insurance salary instead of on the salary actually paid to you.

If you are a self-employed person insured under the YEL or MYEL pension insurance scheme, your annual income will include the reported YEL or MYEL income for the 12 calendar month reference period. The income is calculated only for the period when the insurance was in force.

No other income from self-employment is included in the annual income, for example not wage or salary income from your own business, nor income from self-employment. If the YEL or MYEL insurance has not been in force during the reference period, no income from self-employment is included in the annual income.

Example of annual income calculated on the basis of YEL income

Sanni’s entitlement to pregnancy allowance starts on 15 September 2022. The reference period is 1 August 2021 to 31 July 2022. Her YEL income is 20,000 euros per year. Sanni’s annual income is calculated to be 20,000 euros.

The base amount of the daily allowances for parents is about 47 euros per working day.

The amount of the pregnancy allowance and the first 16 day of parental allowance is about 60 euros per working day*.

*) Working days are Monday to Saturday, with the exception of midweek holidays.

If you are self-employed on a part-time basis, i.e. you have worked as a self-employed person during the reference period and at the same time worked as a salaried employee for another employer, your annual income will, in addition to the reported income under the YEL or MYEL scheme, also include the salary paid to you.

If you have a research or arts grant or scholarship and you have a MYEL insurance with the Farmers' Social Insurance Institution (Mela) based on the grant or scholarship, your annual income is calculated on the basis of your reported income under the MYEL insurance.

If you are not under obligation to take out MYEL insurance, your grant or scholarship is not included in your annual income.

If, after the decision has been issued, you are granted a benefit that should be included retrospectively in your annual income for the reference period, you should notify Kela. That way the benefit can be included in your annual income and the amount of your allowance can be recalculated.

A benefit-based income calculated on the basis of certain benefits that you have received during the reference period can also be included in the annual income.

The benefit-based income is a calculated income. It is calculated on the basis of the average amount of benefits that you have received during the 12 calendar month reference period. The benefits are taken into account at their before-tax value.

Definition of annual benefit-based income:

- Certain benefits that you have received during the reference period are calculated at their average daily amount.

- From the daily amount, a calculated benefit-based annual income is generated.

- The calculated benefit-based annual income is included in the annual income in proportion to the periods for which the benefits were granted.

Only the following benefits are included in the benefit-based income, if they are granted for the 12 calendar month reference period:

- unemployment benefit

- job alternation compensation

- sickness allowance

- daily allowance under the YEL Act or sickness allowance paid by the Farmers’ Social Insurance Institution (Mela)

- partial sickness allowance

- daily allowances for parents

- special care allowance

- sickness allowance on account of human cell, tissue and organ donation

- rehabilitation allowance from Kela

- rehabilitation allowance or rehabilitation increase under the Earnings-related Pensions Acts

- disability pension provided under the Earnings-related Pension Acts

- disability pension provided under the National Pensions Act

- guarantee pension as a supplement to disability pension

- adult education subsidy

- adjustment pension or adjustment allowance for Members of Parliament

- study grant.

Benefits paid to the employer are not included in the annual income. In such a case, the wage or salary that you have received for the same period is included in the annual income.

Example of annual income calculated on the basis of unemployment benefit

Pekka’s entitlement to parental allowance starts on 15 September 2022. The reference period is 1 August 2021 to 31 July 2022. During this period, Pekka received an earnings-related unemployment allowance of 60,00 euros per day for 5 days a week.

The annual income calculated on the basis of the average earnings-related allowance entitles to a parental allowance of about 52 euros. The amount of parental allowance for the first 16 days is approximately 67 euros per working day. Parental allowance is paid for working days. Weekdays are the days from Monday to Saturday. Bank holidays are not counted as weekdays.

Example of how different benefits are taken into account when calculating annual income

During the reference period for the annual income, Laura received an unemployment benefit from which her child home care allowance was deducted. When calculating Laura’s annual income, her unemployment benefit, reduced by the amount of the home care allowance, is included. The child home care allowance is not included in Laura’s annual income, as it is not a benefit that is taken into account when calculating annual income.

Compensations paid for loss of income during the reference period are included in the annual income if the compensation is based on

- an accident at work

- an occupational disease

- a road accident

- a patient injury

- a military injury

- a communicable disease under the Act on Communicable Diseases (sickness allowance on account of an infectious disease)

Compensations for loss of income are taken into account to the amount granted.

However, compensation for partial loss of income is not included in the annual income, if it is paid at the same time as parental allowance. Compensations for loss of income paid to the employer are also not included in the annual income, because you have, for the same period, received wages or salary that is included in the annual income.

3 month income period

In certain situations, the daily allowances for parents can be calculated on the basis of your income for the last 3 calendar months of the reference period. However, this requires that one of the following situations has applied to you during the 12 month reference period:

- You have attained a vocational qualification and completed, for example, a basic vocational degree, a vocational degree or a bachelor’s or master’s degree in higher education.

- You have performed conscript or alternative civilian service.

- You have been partly or completely absent from the labour market after the parental allowance period, because you have stayed at home caring for a child under the age of 3.

- You have been partly or completely absent from the labour market after the parental allowance period, because you have stayed at home caring for an adopted child.

- You have been absent from work because of participating in the medical care of a child of yours that is ill or disabled or the care of a child of yours that is under the age of 16 (home care or hospital care).

- You have moved to Finland from another country and you were not covered by the Finnish national health insurance while living abroad.

A further requirement is that your income for 3 months multiplied by 4 is at least 20% higher than the annual income determined on the basis of the 12 month reference period. The income for the last 3 months of the reference period is taken into account in the same way as the income based on the entire reference period.

Elina begins to receive pregnancy allowance on 15 February 2024. The reference period is 1 January to 31 December 2023. Elina was on child care leave during the beginning of that year and returned to work on 1 August 2023, when her older child turned 3 years old. Elina applies for pregnancy allowance on the basis of her income for 3 months.

Elina received a salary of 2,500 euros per month (before taxes) during the period 1 August to 31 December 2023. Her annual income for the 12 month reference period is thus 12,500 euros.

The annual income calculated on the basis of the last 3 calendar months of the reference period is 2,500 euros x 3 months x 4 = 30,000 euros.

Elina’s allowance can exceptionally be determined on the basis of her annual income calculated on the basis of her income for 3 calendar months, because the annual income calculated in this way is over 20% higher than the annual income calculated for the 12 calendar month reference period, and because Elina has been absent from work while caring for her child that is under the age of 3 years.